The SBA EIDL program sucks and most of you got the big middle finger from the feds, so how about some BETTER alternatives? You’ve asked, and today I am delivering, a massive list of some of the best grants for small businesses. Everything from general business grants to ones specific to veterans, women, or minorities—all this and more in today’s video.

https://www.nav.com/resource/small-business-grants/

https://www.legalzoom.com/articles/24-small-business-grants-to-apply-for-in-2021-a-full-guide

This is video two of a four-part series showing the best small business grant resources available today. In video one, we covered grants for all types of small businesses. Today, we will cover grants specifically for women-owned businesses. In video three, I will cover veteran-owned businesses, and the fourth video in this installment will cover grants for minority-owned businesses.

Now, let’s get started. https://www.wbenc.org/news/behind-the-numbers-the-state-of-women-owned-businesses-in-2018/

The incredible success and persistent challenges faced by women entrepreneurs were evident in two recent reports covering women-owned businesses: the 2018 State of Women-Owned Business Report by American Express and SCORE’s Megaphone of Main Street: Women’s Entrepreneurship Spring 2018 report.

These reports show that while a woman owns four out of every ten businesses in the US, only 25% of women seek additional financing compared to 34% of male entrepreneurs. However, there is no shortage of support for women-owned businesses.

Amber Grant Foundation

https://ambergrantsforwomen.com/

WomensNet founded the Amber Grant Foundation in 1998. Their mission is to help women fund their life dreams. The first week of every month, they give $10,000 to women pursuing their entrepreneurial passions. At the end of each year, they also grant one outstanding woman $25,000 of funding.

Eileen Fisher Women-Owned Business Grants Program

https://www.eileenfisher.com/social-consciousness/environmental-justice-grant

Eileen Fisher is a women-owned clothing brand on a mission to support other women business owners. Their Women-Owned Business Grant program awards women entrepreneurs $200,000 annually. Before applying, you must meet these prerequisites:

- Demonstrate your business has positive impacts on the environment and women's representation.

- Provide and demonstrate helpful information on climate change, mitigation, and advocacy.

- Help lead and engage other women in the sustainable economy.

- Be able to meet all of Eileen Fisher's eligibility requirements.

- Award amount: $10,000–$40,000

- Where to apply: Although funding is temporarily suspended, check their website for updates to see if the program is renewed.

Live Your Dream Award

https://www.liveyourdream.org/get-help/apply-for-an-educational-grant/index.html

Each year, the Live Your Dream Foundation grants $2.1 million in educational funds to women. This foundation focuses on passionate women who have survived sexual violence or other traumatic events. They offer programs and funding that help women build confidence, advance their careers, and overcome unexpected situations.

- Award amount: $1,000–$16,000

- Where to apply: Applications open from August 1 to November 15 at this online portal.

Cartier Women's Initiative Award

https://www.cartierwomensinitiative.com/regional-awards

No matter where you live, you could have a strong chance of earning grants via the Cartier Women's Initiative Award program. This grant program was created for eco-friendly and sustainable women-owned businesses around the world. Cartier's team helps provide monetary, social, and human capital support to ambitious women leaders. They have two different funding types: regional awards and science and technology pioneer awards.

- Award amount: $30,000–$100,000

- Where to apply: They are getting ready for their Spring 2022 grant cycle, so now is the time to prepare for this grant.

Boston Women’s Fund

https://www.bostonwomensfund.org/our-work/#apply

The Boston Women’s Fund provides seed money, program support, and operational funding for women-led grassroots community efforts. You can check out their website for all of the details. I hope these grants can help you out. Are there any ones I have missed? Let me know down in the comments! Also, what type of business do you run? Sharing that information with me allows me to make videos more tailored to your needs. Thanks

Don’t forget to check out www.OpenFor.Business and register your business today. As you know, this is my small business awareness campaign, along with Aubrey Janik, Jamel Gibbs, Minority Mindset, Investment Joy, Rod Squad, Kenny Keller, Kristen Ottea, and Mark Moss; we will fly around the country in a helicopter landing at select small businesses nationwide. Do you want me to land the helicopter at your office or feature you on the program? Go to the website and register your business now. These spots are very limited

I am so excited to announce the support from AutoCorner, Namecheap, BestBuy, ZipRecruiter, Dun & Bradstreet, Constant Contact, and Unbanked. Without their support, this nationwide small business helicopter tour would not be possible!

Follow Me On...

Steven creates video interviews with interesting people with extraordinary stories from various walks of life, sharing their successes and failures.

Full-length interviews and shorts are available on YouTube, with behind-the-scenes content and photos on Instagram and Facebook.

Keep Up to Date!

Subscribe to Steven's email list to be notified when new content is released!

Bell 206L4

For longer, multi-day, or multi-state trips, I usually fly a Bell 206L4 helicopter which seats two pilots in front and five passengers in the back.

R44 Raven II

For shorter, single-day, local 'Tampa Bay Area' videos, I usually fly a smaller R44 Raven II helicopter, which seats two pilots in the front, and two passengers in the back.

Get in touch

Have a suggestion for an interview or video?

- Corporate address

-

The Carlson Organization, Inc.

18 2nd Street

Luray, VA 22835 - Phone number

- +1 (540) 742-7001

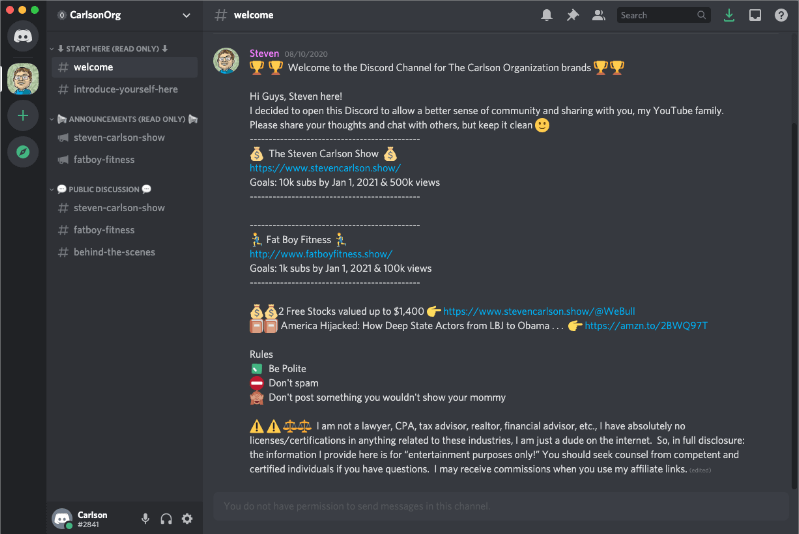

Join our community on Discord

Join in the discussion and share your insights with the community.

Join Now it's free

subscribe

subscribe